The Effects of Nudging on Pension Savings Decisions

“Choices don’t automatically work out”

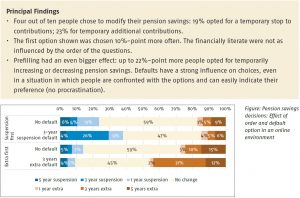

Choice is a vital element in the design of a pension system. This study shows that there is considerable appetite for having options in the accumulation phase. However, people with little retirement savings choose to temporarily suspend their contributions just as often as those with considerable savings. Any choices ultimately offered should therefore be designed responsibly. Even in an online environment requiring little effort to change choices, people tend to choose the first option shown or the prefilled one (default).

Key Takeaways for the Industry

- There is considerable interest in making extra contributions or suspending them, but such choices don’t automatically work out. Decisions concerning more or less pension savings are not related to pension entitlements already accrued, savings deposits, or home equity.

- In an online environment, both the order in which questions are presented and default options can help steer people in the right direction.

- Offering the right default options to the right target group requires suitable customization, since people for whom the default may not be appropriate tend to choose it anyway just as frequently.