Investment policy in the case of uncertainty about risk aversion and budget

“Robustly optimising an individual’s pension even when many factors are unknown”

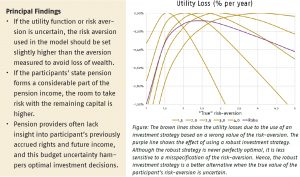

In the new Dutch pension agreement, pension funds will switch from collective to individual pensions. Participants will have a personal pension capital that will be invested according to their age and risk aversion to reach a target pension. Information needed to determine the optimal investment policy in such a scenario is often missing in practice. Therefore this study seeks a robust investment strategy that allows for uncertainty about the specificity of the utility function, risk aversion and the participant’s budget (how high are rights already accrued and rights to be built up).

Key Takeaways for the Industry

- Pension providers should agree on an optimisation standard to ensure that optimising their part of the participant’s budget does not lead to an overall sub-optimal result for the participant.

- The standard should be based on a pension capital that assumes pension accrual throughout a participant’s working life to minimise budget uncertainty and optimise risk.