Genetic health risks, insurance, and retirement

“Striking a balance between rising premiums and genetic discrimination is a regulatory dilemma”

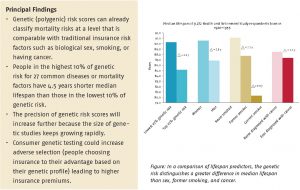

The precision of genetic tests is increasing fast, as is the commercial interest in offering con-sumers genetic tests to predict their lifetime risk of developing medical conditions. Consumers could use such genetic information to their advantage when they purchase insurance, which could lead to rising premiums. If insurers would underwrite genetic risks in return, this could lead to genetic discrimination. Thus, genetic testing puts the regulatory dilemma between affordable insurance policies and the prevention of discrimination into the spotlight.

Key Take Aways for the Industry

- Policymakers need to strike a balance between keeping private insurance fair and viable while protecting consumers against genetic discrimination and privacy violations.

- International agreements are needed to regulate consumer genetics as samples can be sent between countries and not all commercial genetic tests are accurate enough or explained properly.