Shared equity mortgages as boost for mobilising home equity

“Pension funds hold the key to increased household liquidity and reduced housing market risks”

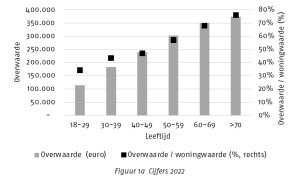

About 1,200 billion euros are tied up in home equity on the Dutch housing market. Although that wealth is at risk if house prices fall, these assets can nevertheless be mobilised for other purposes. At the moment, home equity is scarcely used. This paper investigates how the introduction of shared equity mortgages (in which the value of the loan upon repayment moves with the market value of the home) can break this impasse in risks and liquidity.

Key Takeaways for the Industry

• Pension funds can take the lead in this mortgage innovation as a trusted partner and ensure a better distribution of housing market risks.

• Clarity is needed about the division of responsibilities and possible liability risks for pension funds. In addition, good guidance for consumers is needed. And, where necessary, this should be supported by legislation and regulatory measures.

Want to know more?

Read the paper Shared equity mortgages as boost for mobilising home equity from Casper van Ewijk Amsterdam University College), Arjen Gielen (Chairman of the Board SVN), Marike Knoef (Leiden University), Mauro Mastrogiacomo (Free University Amsterdam) and Alfred Slager (Tilburg University).