How do pension funds involve their participants in their socially responsible investment policy?

“There is no one size fits all approach”

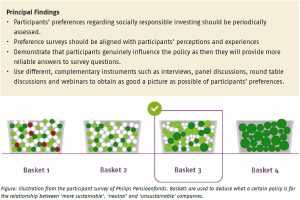

Pension funds are making real strides forward with socially responsible investing (SRI). This is due to a growing emphasis on environmental, social and governance factors in legislation and wider initiatives such as the UN Sustainable Development Goals. Pension fund boards must consider numerous factors when formulating their SRI policy. So how do they ensure that their choices reflect their participants’ preferences? And how do they determine what those preferences are and whether these change?

Key Takeaways for the Industry

- There is not a one size fits all approach to assessing preferences as each participant population has its own characteristics.

- Enter into a dialogue with participants about the dilemmas surrounding socially responsible investing so that they can better place the choices made.

Want to know more?

Read the paper ‘Hoe betrekken pensioenfondsen deelnemers bij hun maatschapppelijk verantwoord beleggingsbeleid’ by Rob Bauer (Maastricht University), Reinout van Tuyll van Serooskerken (Achmea) and Eric Veldpaus (Institutional Benchmarking).